Articles

The https://happy-gambler.com/sizzling-hot/real-money/ brand new longest Cd identity paying at least 5.00percent is now 14 months, which would make sure a great 5.05percent speed until almost December 2025. FinanceBuzz analysis and you will costs issues to your many different decimal and you can qualitative standards. Whenever possible we attempt per equipment and can include all of our truthful, personal sense utilizing it.

Millionaires Nearby: Precisely what the Average Wealthy Individual Looks like inside the 2025

With Cds, the rate is important, in addition to offered exactly what the minimum put are and you will one early withdrawal fines. When you put your cash in a Computer game, you get a fixed interest rate to own a certain number of date to the currency you put when you unlock a merchant account. LendingClub also offers Computer game words anywhere between half a year in order to 5 years and you may earn around cuatro.50percent APY. There is certainly a dos,500 minimal expected to unlock a good Cd account and you can deposit up to 250,000. High Produce Cds and you can Improve your Price Dvds have early withdrawal punishment one vary centered on the Video game term. To your No Penalty Video game, withdraw all of your currency any time following first six weeks following the time you financed the brand new account and maintain the attention gained no penalty.

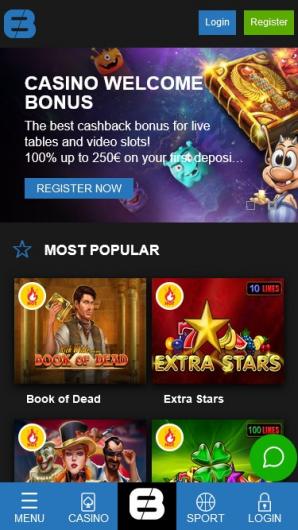

High 5 Casino zero-put incentive FAQ

Since the BMO Savings Creator Membership now offers a fairly lowest APY, they encourages one not touch your own savings because you rating compensated each month via your first year if you look after a good minimum of 2 hundred inside the discounts. He’s adjustable interest levels, so they can improvement in a reaction to interest alter introduced from the Federal Set-aside. The brand new Government Set aside matches eight moments a-year (all six-weeks) but can see with greater regularity whenever monetary events want it. Imagine if the FanDuel Michigan Gambling establishment’s sign-up bonus are a good “2,100 Get involved in it Once again” render.

Score instant access in order to people-simply services countless deals, a free of charge 2nd registration, and you will a subscription to help you AARP the newest Mag. • Read the Internal revenue service Get My Percentage web equipment to own determining if the stimuli percentage could have been awarded. You are now leaving AARP.org and you can likely to an internet site that isn’t work because of the AARP. If you’re also looking a hassle-totally free, protected means to fix build your money, you may want to research past all of our antique financial institutions.

Get a 50 bonus to possess finding head dumps anywhere between step one,000 and you will 4,999.99. Unfortunately for savers, past month, the newest Given kicked from what is likely to end up being a few price slices, you start with a significant 0.fifty percentage part reduction to the Sept. 18. For every Provided disappear that comes to take and pass have a tendency to place down pressure for the savings account cost.

Which psychological suggestion the most common pro preservation tips one promote these to build other deposit and you will enjoy more to your picked website. At CNBC Come across, the goal is always to offer our clients with high-quality solution journalism and comprehensive individual advice for them to generate informed choices with their currency. The checking account remark is dependant on strict revealing from the all of us of professional writers and writers that have extensive expertise in banking points. See all of our methodology for additional info on how we choose the best deals membership. Remember that bonus offer number vary, and better-end incentives tend to want a higher put of cash.

Because of the Federal Reserve’s aggressive rate-walk venture away from 2022–2023—which aimed to bring off many years-high rising prices—costs to your high-yield discounts profile surged on the highest height inside more 20 decades. Getting together with a maximum of five.55percent within the April, the leading nationwide rate continues to be near one, during the 5.50percent APY. Perform to regulate private banking companies have long become, and therefore are going to remain, complicated. As the powerful profit-and then make organizations, financial institutions has usually resisted and you will circumvented regulating operate because of the looking the fresh channels to benefit (HR&A Advisors 2024; DiVito 2024). Treasury costs, which pay attention in the event the expenses grows up inside attacks out of 4, 8, 13, 17, twenty six, or 52 days.

How does a leading-yield savings account works?

Anyone created between your twenty-first and 31st of any day often provides the pros paid off to your July twenty-four. Feedback shown here are the author’s by yourself, not that from people bank, bank card issuer, airline, or hotel chain, and have not been reviewed, recognized or otherwise endorsed by the these organizations. These are some of the banking companies millionaires use to help perform its money. Goldman Sachs Personal Riches Management makes sense when you yourself have more 10 million inside the investable property and choose curated money.

Account holders could only generate deposits thru mobile look at put, automated cleaning house (ACH) import or wire import. The brand new account doesn’t have month-to-month charges and there’s zero minimal deposit demands to start a merchant account. Meanwhile, but not, banking institutions always discover ample possibilities to profit from Western families, particularly by far the most financially insecure. Banks have been in a continuing hands race which have authorities and they are usually looking to innovate the brand new costs, see loopholes, otherwise lobby away problematic limitations. When you’re overdraft and you may NSF income has fallen rather over the past while, annual lender money of membership maintenance and you will Atm costs has increased by the up to 1.6 billion since the 2020 (Gdalman et al. 2024).

So it lender extra are smaller plus the added bonus requires lengthened to help you be paid compared to most other also offers on the our list, however, requirements is straightforward. Rating a money extra to have beginning one of the recommended on line deals accounts available. Of your own family savings also provides to your the listing, Discover’s demands a few of the most significant deposit numbers. However with their aggressive step three.70percent annual commission produce, it’s maybe not an awful idea to help you sock out what you could inside membership. Financial promotions generally include cash incentives once you discover a the new examining or family savings. In order to qualify for this-date brighten, you’ll have likely to arrange lead deposit to the bank and sustain the new membership open for around two months.

Joss is even a specialist regarding extracting exactly what gambling enterprise incentives create well worth and how to locate the newest offers you dont want to skip. Financial institutions that offer a bank checking account incentive to help you the brand new account holders were Lender away from The united states, BMO, Money One to, Pursue, KeyBank, PNC Financial, SoFi Lender, N.A good., TD Bank, You.S. Financial and you may Wells Fargo. Come across this page per month for the best bank account promotions available. You can generate it incentive that have one of two checking membership at the financial — a regular bank account otherwise the one that doesn’t allow it to be overdrafts. As the deposit criteria are extremely high, the fresh membership’s interest of 4.10percent to possess stability out of 5,000 and better would be a persuasive reasoning in order to sock out such a large share.

At the same time, low-earnings People in america that do financial often encounter discrimination inside accessing basic banking services. Research has repeatedly identified disparities both in plan as well as in behavior for Us citizens from fraction racial and you can cultural backgrounds (DiVito 2022a). To decide and this certificates of deposit (CDs) give you the finest come back on your currency, CNBC Discover assessed all those Computer game accounts supplied by online and brick-and-mortar banking companies, along with highest credit unions. We learned that the newest annual commission give (APY) supplied by on line banks and you will borrowing from the bank unions much outpaced those people given by the very federal stone-and-mortar banking institutions. While many borrowing unions features an excellent Computer game alternatives, only those which make membership widely accessible have been felt. A great CD’s APY ‘s the level of interest you to a merchant account brings in in the annually.

Recent Comments